CIF Evaluation & Learning: What Are We Learning About the Big Issues in Climate Finance?

The scale and urgency of the climate crisis demands rapid action to prevent a range of consequences – from increased droughts and floods to huge economic losses and more extreme natural disasters.

All major climate funds and practitioners are struggling with a basic yet essential question: How do we best leverage scarce public resources for maximum impact?

The risks of climate change are evidence-based - and there is a critical role for using evidence-based learning to help create and leverage the transformative investments needed to address these risks.

At the Climate Investment Funds' (CIF) Evaluation and Learning (E&L) Initiative, we are drawing on experience from across the CIF portfolio of investments in clean energy, forests and resilience to identify best practices and lessons that are timely and relevant. Over the last two years we have commissioned over 30 strategic and demand-driven studies covering some of the most pressing challenges facing climate finance funders and practitioners. (Read the list of evaluations here.)

I often explain that these are not like traditional project evaluations. In other words, they are not focused on single projects or programs, or on compliance or accountability issues. Instead, they address the big themes and issues in climate finance today, such as how to draw in private sector investment, or how to design a funding mechanism to help further empower Indigenous Peoples in sustainable forest management. We are now coming to an exciting time, with many of these studies set to be released in late 2018 and early 2019. Now it's time to start asking: What are the lessons emerging from this broad and diverse evaluation and learning portfolio?

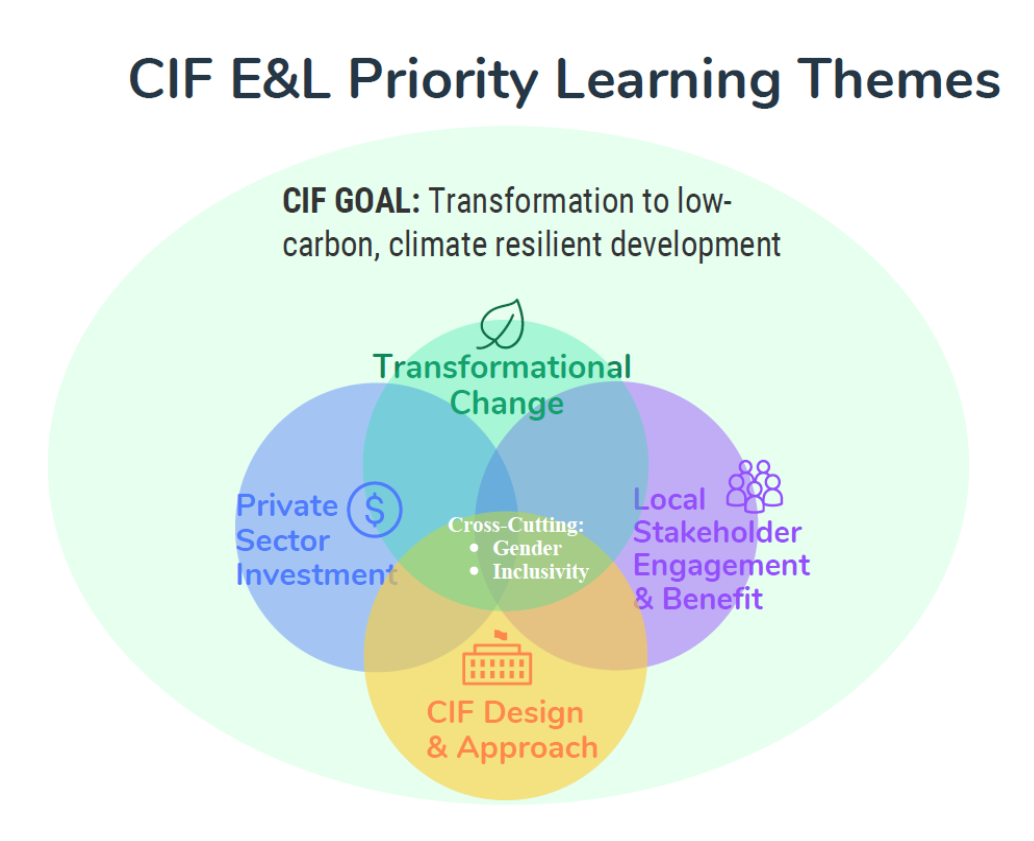

The CIF's Evaluation and Learning Initiative prioritizes four key learning themes and related sub-topics, developed through wide consultation and dialogue. Broadly, these include:

- Transformational Change: Understanding and assessing CIF's contributions to transformational change, across its four programs.

- Private Sector Investment: Investigating different financing models and learning from experiences in CIF programs and sectors, including the role of concessional finance.

- Local Stakeholder Engagement and Benefit: Exploring CIF local stakeholder engagement strategies and impacts, as they relate to Indigenous Peoples, gender and other local actors.

- CIF Design and Approach: Evaluating the effectiveness of the CIF Programmatic Approach as a delivery modality, as well as other program-specific strategies and approaches.

To address the urgent need for climate action, it is imperative to learn which types of interventions have the potential to be transformational. Climate finance organizations seek interventions that can lead to large-scale, sustainable impacts to mitigate climate change. Transformational change in this context refers to strategic changes in targeted markets and other systems with large-scale, sustainable impacts that accelerate or shift the trajectory toward low-carbon and climate-resilient development.

To make this topic more manageable and concrete, we recognized the need to first develop a common framework for assessment that can be adapted to different country, program and sector contexts. We also decided to bring in a range of practitioners, experts and evaluators to help us better understand how transformation can be identified and assessed in the context of climate finance. We are currently doing this through a three-pronged approach: i) an independent evaluation of transformational change in the CIF context; ii) an evidence synthesis including analysis of over 80 different studies on this topic; and iii) a set of facilitated learning workshops with CIF stakeholders and external experts, including representatives of other climate funds, to jointly explore emerging findings.

With workshops underway this month and final reports due to be launched in January, this work is poised to help inform strategic choices both within the CIF and externally. Watch this space for a follow-up blog in the coming weeks, including more reflections on the framework and emerging findings!

The achievement of Paris Agreement targets – and more broadly, the Sustainable Development Goals (SDGs) – requires going from billions to trillions in finance leveraged. Increased private sector investment is essential to achieving this goal.

Early findings from CIF evaluations indicate that private investment leveraged by the Clean Technology Fund (CTF) has contributed to important shifts in key markets, such as Mexico, Thailand and Turkey. Scaling up private investment in climate resilience and sustainable forests remains a challenge. However, several studies are pointing to positive examples of intermediated finance – provided through local banks to small-scale businesses and communities in vulnerable areas – as an effective way to build and scale local climate resilience and sustainable forest-related enterprises. Examples include projects supported by the CIF Forest Investment Program (FIP) in Mexico and by the Pilot Program for Climate Resilience (PPCR) in Tajikistan and Jamaica.

Evaluations and other studies will be released in the next few months analyzing the role of CIF and concessional finance more generally in building robust commercial markets for clean energy, climate resilience and sustainable forests. Watch this space for continued emerging learning on this key topic.

Local Stakeholder Engagement and Benefit

A number of climate funds and practitioners are interested in learning how to best engage and support Indigenous Peoples in natural resource management and forestry work. Findings from a review of the Dedicated Grant Mechanism (DGM) for Indigenous Peoples and Local Communities (IPLCs) in the CIF's Forest Investment Program (FIP) are striking.

The DGM is an innovative model for directly engaging and funding IPLCs, recognized as critically important to sustainable forest management. The review finds evidence that the DGM is leading to broad and potentially transformational outcomes. It indicates that the DGM has helped Indigenous Peoples feel a sense of ownership of initiatives that bring benefit to themselves and the forests on which they depend, and that it has increased trust and participation in wider national and international initiatives. In three areas – land titling, natural resource management, and income generation – there are indications that the DGM is leading to important substantive outcomes, which are the material effects of IPLC-owned projects or activities. For example, with the support of the DGM process, Peru has established recognition of land claims for 180 communities and has committed to titling 130 communities. Importantly, the review points to critical success factors in different countries, and provides lessons for replicating, adapting or scaling the program in other contexts, with practical guidance for how a DGM project can be conceived. This review is in the final stages and will be launched soon.

Other studies on gender, leadership, and household-level impact are also underway and will provide additional learning on these important themes.

The CIF Programmatic Approach is a critical and unique component of the CIF business model. It consists of the development and implementation of a country-led investment plan supported by multi-lateral development bank (MDB) collaboration, multi-stakeholder consultation, and a predictable and flexible resource envelope. The idea behind the Programmatic Approach is to plan for strategically linked project investments, unified by a transformative vision for a country or sector.

An independent evaluation of the CIF Programmatic Approach is finding that this process can help set the stage for transformative change at the systems level, and that it has important advantages over a project-by-project approach. For example, in Zambia, the programmatic approached helped the government to integrate climate resilience into wider national development and sector plans. Of course, multiple factors can enable or constrain the approach in different country, program and sector contexts. The evaluation found that clarity of implementation mechanisms and incentives, flexibility, and country-level leadership are particularly important. Evaluation findings and lessons will help inform ongoing discussions on how the CIF and other climate funds, donors, banks and recipient countries can best support country-level climate action as expressed in the NDCs and national development plans. The full evaluation report will be available in the coming weeks; look out for more insights and lessons from this exciting and important evaluation.

Evidence-based learning takes time, resources, and deep commitment from leaders and program implementers. However, without it we are more likely to repeat past mistakes or constrain the potential transformative impact of climate investments. The CIF's approach and commitment to demand-driven evaluation and learning is yielding a wide set of emerging learning on the most critical topics in climate finance today. We look forward to sharing further insights and lessons as reports are launched in the months ahead!

This blog was originally featured on the Climate Invesment Fund website on October 17, 2018. To see the original post, click here.