What the Green Climate Fund Can Learn from Climate Investment Funds Evaluation

The evaluation of the Climate Investment Funds (CIF) has been published and contains plenty of food for thought for board members of the Green Climate Fund (GCF), its stakeholders and the overall international climate change community focused on finance.

Primarily designed to evaluate the performance of the CIF, six years after creation, this evaluation provides additional value from the perspective of formulating clear recommendations for consideration by the GCF. The Green Climate Fund is still to go fully operational.

The evaluation team from ICF International managed by an Evaluation Oversight Committee (EOC) composed of representatives from Independent Evaluation Offices of Multilateral Development Banks rendered evaluative judgment on the CIF from the perspective of its current and future role, governance, management, operations, quality control, transformative model, risk management, private sector engagement, investment plan and promotion of national ownership.

In June 2014, CIF stakeholders broadly discussed the results of the evaluation at the Partnership Forum in Montego Bay, Jamaica as part of their learning efforts.

But in Songdo city, South Korea, Headquarters of the Green Climate Fund -- just about pivoting into full operation, the evaluation may have some wide ranging implications.

3 Lessons from the Evaluation for the Green Climate Fund

-

'Transformation' & 'Paradigm Shift' are hard to Measure

The Climate Investment Fund is touted for its 'transformative' nature with a business model designed to address some serious and contentious issues raised by developing and developed countries alike in international climate change negotiations. Under the United Nations Framework Convention for Climate Change (UNFCCC), the mandate assigned to the Green Climate Fund stipulates that it will "promote the 'paradigm shift' towards low-emission and climate-resilient development pathways by providing support to developing countries to limit or reduce their greenhouse gas emissions."

On this aspect, the evaluation found out that while "some (CIF) projects are plausibly transformational; others lack a convincing logic of transformation and impact". And therefore recommends for consideration to the Green Climate Fund that "...its goal of promoting 'paradigm shifts' will, like 'transformation', encounter definitional and measurement problems."

-

Governance

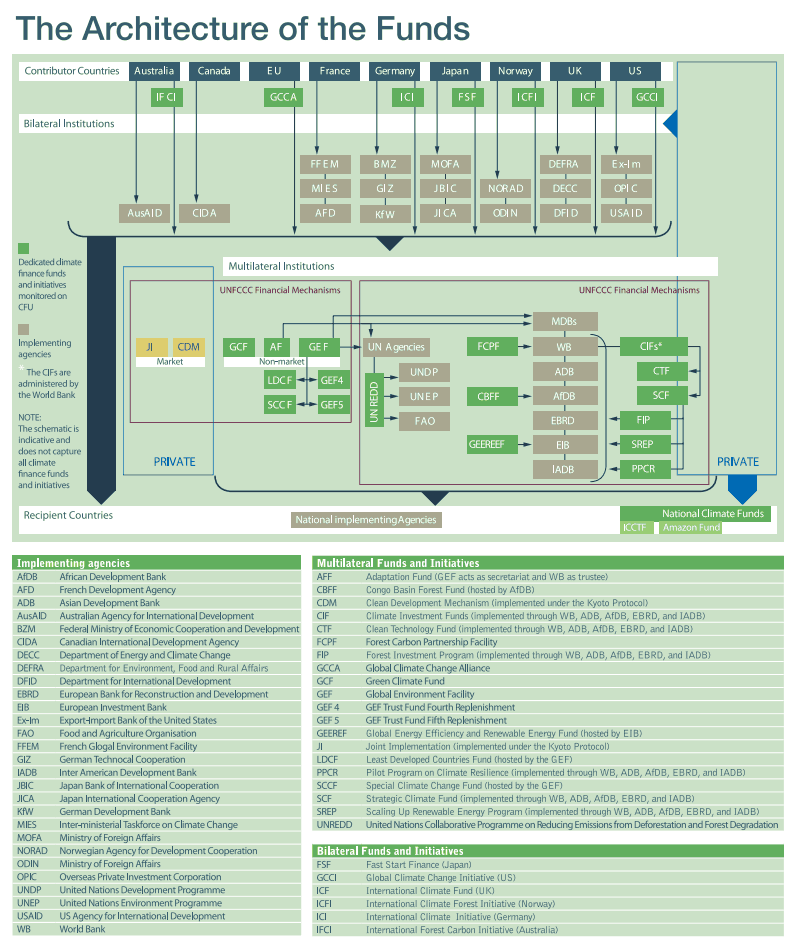

A major area of contention between parties to the UNFCCC is governance, transparency and accountability of climate finance. The evaluation finds that "CIF governance structure has achieved legitimacy in design through inclusive and balanced framework, and expanded role of observers, and good disclosure and transparency." However, the evaluation finds out "efficiency and effectiveness has been hindered by the CIF's complex architecture, consensus decision rule and lack of secretariat with strong executive function."

While the GCF may not face similar challenges with respect to a strong secretariat as they have one currently being set up, the evaluation highlights the fact that consensus decision making comes at a cost -- with 'advantages and disadvantages.'

-

Learning and Evaluation

Climate evaluation is new and M&E systems are just being set up at project, program and national levels. While the CIF design mandated an evaluation after three years of operation, the evaluation highlights the fact that there is no provision for independent evaluation at the national, program, fund level or a summative evaluation. Unlike the CIF, the Green Climate Fund has assembled an Independent Evaluation Unit definitely with implications expected on learning and evaluation.

So what does this mean for the Green Climate Fund from the perspective of learning from monitoring and evaluation? The evaluation states that "there are substantial needs for capacity building at the national level to be able to track and analyze progress towards low-carbon and resilient development.

Many have described the Climate Investment Funds as 'a best practice' model for the Green Climate Fund. Yes, they may be many 'best practices' to adapt from the CIF to make GCF more effective and efficient. But this is a first step. This evaluation suggest that a second step would be to critically learn from the challenges of the CIF from the perspective of cutting through obstacles to meet the needs of vulnerable communities and effectively address the effects of climate change on the ground in client countries. For the GCF in particular, the evaluation seems like valuable and timely inputs to continue the process of designing a business model that would further respond adequately to the recent needs of client countries as articulated in international climate change negotiations.

Related articles: